Present Worth Interest Variable of Annuity (PVIFA)

Present Worth Interest Variable of Annuity (PVIFA)

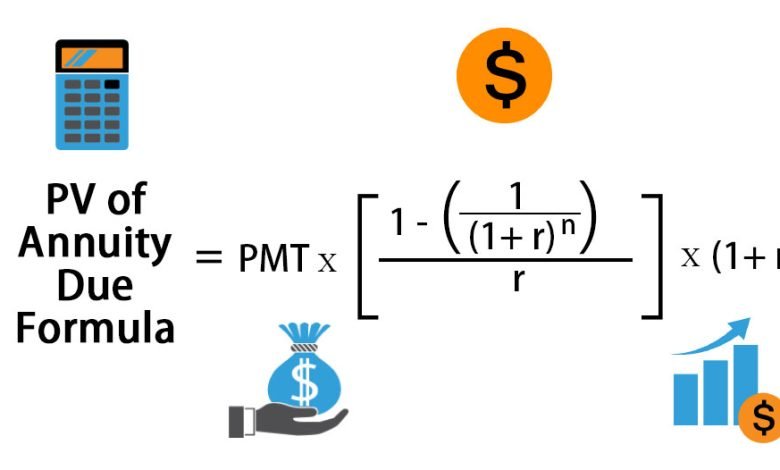

The PVIFA Mini-computer is a device to work out the ongoing worth of the incomes from an annuity with only a single tick rapidly. The current worth interest component of the annuity computes the current worth of variable annuities. This idea of the current worth from the time worth of cash verifies that the worth of a solitary penny that is gotten today is more than the worth that it will be from now on. pvifa calculator is helpful for computing the current worth of the annuities to be gotten from now on.

Understanding of PVIFA

This main infers that the worth of $1 today is higher than the worth following 5/10 years or the given future time frame.

“The principal issue with BMI is that it doesn’t recognize fat mass and non-fat mass,” says Dr. Orison Woolcott, head of a new report to try out a better approach to quantify muscle to fat ratio.

Meanwhile, it’s a valuable method for following your very own information, he recommends. For instance, in the event that you’re dealing with getting thinner, this is a straightforward and productive method for following how much muscle to fat ratio you’re shedding.

Instructions to work out your general fat mass (RFM)

The excellence of rfm calculator that it tends not set in stone with nothing more modern than a measuring tape and some basic math.

In the first place, get a measuring tape and record your level and your midriff periphery.

Then, at that point, plug the numbers into the recipe:

• Men: 64 – (20 x level/midriff perimeter) = RFM

• Ladies: 76 – (20 x level/midriff perimeter) = RFM

Advantages of utilizing PVIFA

The greatest benefit of utilizing PVIFA is that it empowers you to settle on your installment. It shows whether you ought to take a proper sum back now or acknowledge an annuity installment framework over years.

As referenced over, the PVIFA recipe has a financing cost that can assist you with checking what you will get toward the finish of the annuity installment period. By utilizing the financing cost, you can get a last sum that you will move past a timeframe in annuities. If you have any desire to get more data then you can visit here calculatorsbag.

Presently, you can contrast this sum and the proper one that you are proposed to take right now. Along these lines, you can have a thought of what will be more valuable for yourself and which strategy you ought to acknowledge for your installments.

However, remember that you ought to have the financing cost and the annuity period to work out PVIFA from a manual as well as a PVIFA number cruncher. It can’t be determined without these terms or values. I have

How to utilize (PVIFA)?

We should assume that you have put resources into a startup that conveys 3D printers. The speculation of the startup will bring about you getting eight installments of $3,000 – one every year. The financing cost, as currently referenced above, is identical to 4%. What can be the current worth of this annuity?

1_Distinguish the no.of periods and loan cost. For this situation, we have n= 8, and r= 4% = 0.04.

2_Calculate PVIFA as indicated by the PVIFA equation:

If you want to get more information related to education then you can visit here businesshear.com